If you have received a demand notice from Income Tax Department then you must respond to it at the earliest. Whatever reasoning or points you wish you raise with the department, you must pen them down in your response letter which will be helpful in bringing clarity on the matter. Such letters are very much to the point and must be written in a formal manner. If you don’t know how to frame a letter to income tax department for demand notice then we are here to help you with the situation.

Given below is a sample letter to IT department for demand notice which you can customize and use to write your own.

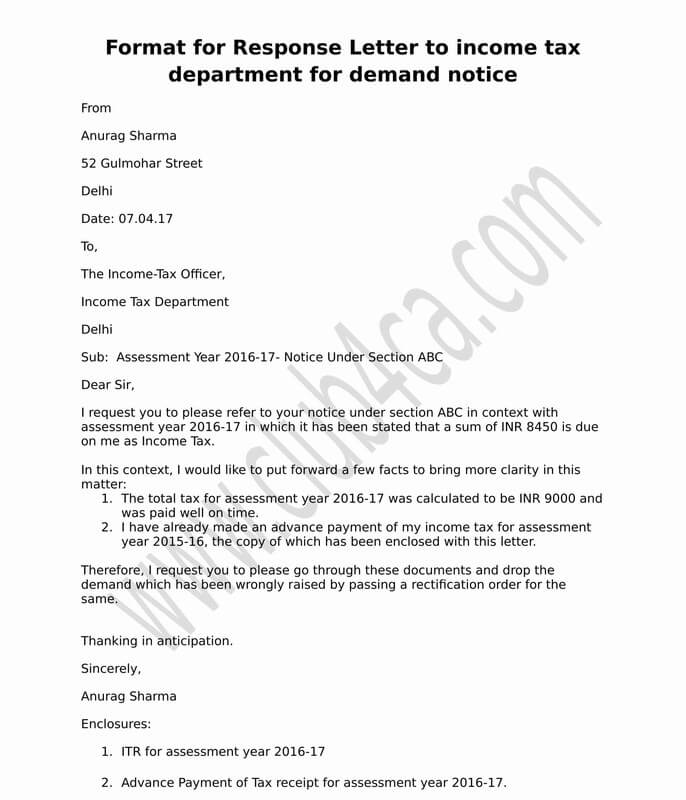

Format for Response Letter to income tax department for demand notice

From

Anurag Sharma

52 Gulmohar Street

Delhi

Date: 07.04.17

To,

The Income-Tax Officer,

Income Tax Department

Delhi

Sub: Assessment Year 2016-17- Notice Under Section ABC

Dear Sir,

I request you to please refer to your notice under section ABC in context with assessment year 2016-17 in which it has been stated that a sum of INR 8450 is due on me as Income Tax.

In this context, I would like to put forward a few facts to bring more clarity in this matter:

- The total tax for assessment year 2016-17 was calculated to be INR 9000 and was paid well on time.

- I have already made an advance payment of my income tax for assessment year 2015-16, the copy of which has been enclosed with this letter.

Therefore, I request you to please go through these documents and drop the demand which has been wrongly raised by passing a rectification order for the same.

Thanking in anticipation.

Sincerely,

Anurag Sharma

Enclosures:

- ITR for assessment year 2016-17

- Advance Payment of Tax receipt for assessment year 2016-17.

Click Here To Download letter to Income Tax Department for Demand Notice

Check this: Know more about different types of income tax notices

You May Like also Income Tax Department Letter

Letter Format for Changing Email and Contact Number in Income Tax Department

Format for Change of Address Letter to Service Tax Department

Letter to Income Tax Department for Refund

Letter to Income Tax Department for Rectification

Reasons for income-tax notices

Condonation of delay income tax letter format

Top File Download:

- letter to income tax officer

- letter to income tax department for change in type of payment

- letter format to an officer

- letter to tax department

- sample letter to income tax department requesting for temporary password for efiling

- DRAFT RESPONSE TO INCOME TAX NOTICE

- letter to commissioner of income tax

- application format to income tax department

- how to write a letter of request format

- format for complaint letter for non receipt of income tax refund

Dear sir

I have received income tax notice under section 221(1) please solve my problem

I have received an intimation u/s143(1)(a) regarding mismatch between Form 26AS and my ITR.I want to pay the amount and revise my return as directed by the Tax Dept.Pl. clarify whether I should pay the amount under major head 0021-300(self assessment tax or 0021-400 (Regular Assessment).

I Have received notice from sales tax department for difference turnover as per Income tax return & sales tax return . Please provided format of letter to apple to Sales tax Department.

Please help ..

I want letter format for copy of assessment order to income tax officer.

write a letter to IT dept. client is died no need to file the return & surrender PAN