Goods and Service Tax is the indirect tax that is levied on supply of goods and services in India. It is a multistage and comprehensive tax. As per the rules and regulations, there are different kinds of companies which fall under the exempted category of GST and therefore, GST is not applicable on them. In such a scenario, the need for writing a letter for GST not applicable surfaces.

In this post, we bring to you a sample Letter for GST not application. If you fall in the category which exempts you from GST then you can use this letter format as the base for creating a customized draft.

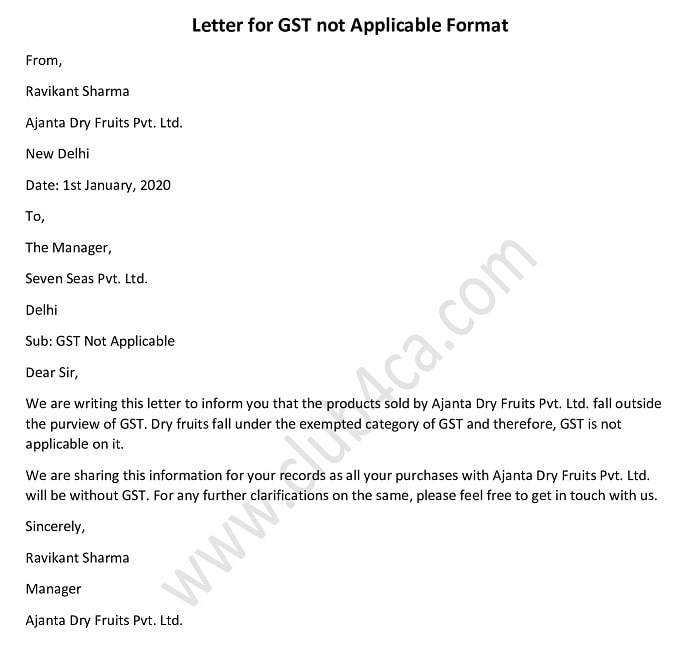

Letter for GST not Applicable Format

From,

Ravikant Sharma

Ajanta Dry Fruits Pvt. Ltd.

New Delhi

Date: 1st January, 2020

To,

The Manager,

Seven Seas Pvt. Ltd.

Delhi

Sub: GST Not Applicable

Dear Sir,

We are writing this letter to inform you that the products sold by Ajanta Dry Fruits Pvt. Ltd. fall outside the purview of GST. Dry fruits fall under the exempted category of GST and therefore, GST is not applicable on it.

We are sharing this information for your records as all your purchases with Ajanta Dry Fruits Pvt. Ltd. will be without GST. For any further clarifications on the same, please feel free to get in touch with us.

Sincerely,

Ravikant Sharma

Manager

Ajanta Dry Fruits Pvt. Ltd.

Check Here to download Letter for GST Not Applicable in Word Format

You May Like Also GST Letter Format

GST Refund Power of Attorney Letter Format

Consent Letter Format For GST Registration

Letter to Vendor for GST Mismatch

No Objection Certificate Format for obtain GST Registration

GST Revocation Request Letter Format