When any company intends to carry out the business operations then it should have a registered place that is either leased or is owned. And if the premises are owned by the owner then the company must submit the document while submitting the GST registration which supports the ownership of premises and in case it […]

Continue reading…

Posts tagged with 'GST'

Letter of Authorization for GST Sole Proprietorship

If you are a sole proprietorship then you need to register for GST if your business turnover exceeds a specific amount. And for that a letter of authorization of GST is written. Just like Partnership Authorization Letter, Letter of Authorization for GST Sole Proprietorship forms an important document that registers your firm for GST. The […]

Continue reading…

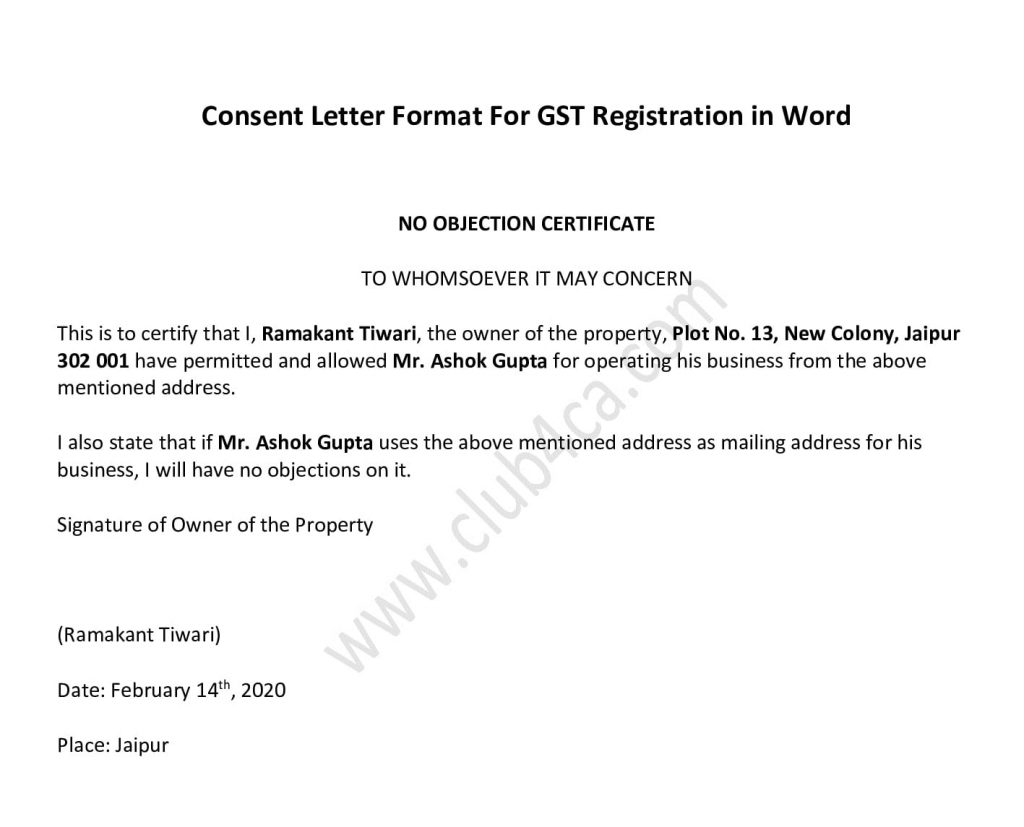

Consent Letter Format For GST Registration in Word

A consent letter is a formal document which provides an evidence stating that the owner of the property has given the permission for the business to operate from his or her place. You can use this authorization letter format for GST registration. This consent letter for GST is on stamp paper and is signed by […]

Continue reading…

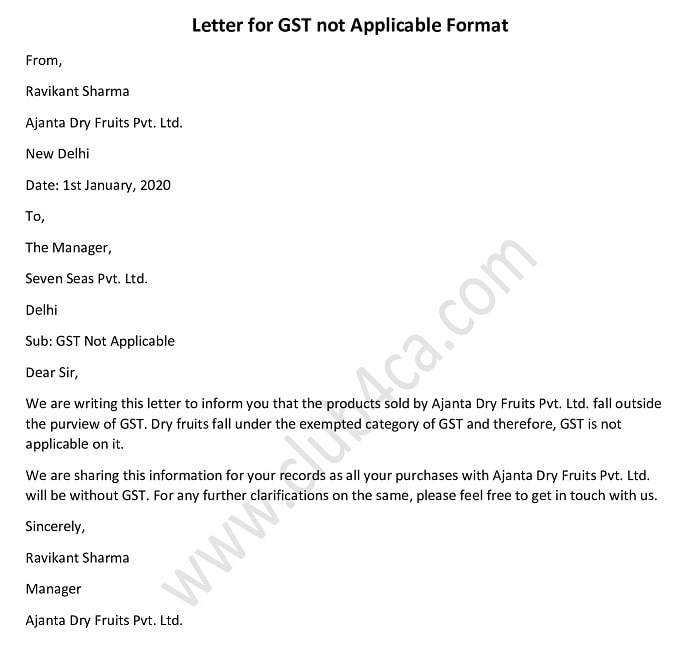

Letter for GST not Applicable

Goods and Service Tax is the indirect tax that is levied on supply of goods and services in India. It is a multistage and comprehensive tax. As per the rules and regulations, there are different kinds of companies which fall under the exempted category of GST and therefore, GST is not applicable on them. In […]

Continue reading…

FAQ on E commerce under GST

In last couple of years, e-commerce has become the latest business trend not only across the world but also in India. Ecommerce platform helps sell all kinds of products and services digitally. That’s the reason the numbers in suppliers is increasing and so are GST FAQs in relation with GST application on selling of different […]

Continue reading…