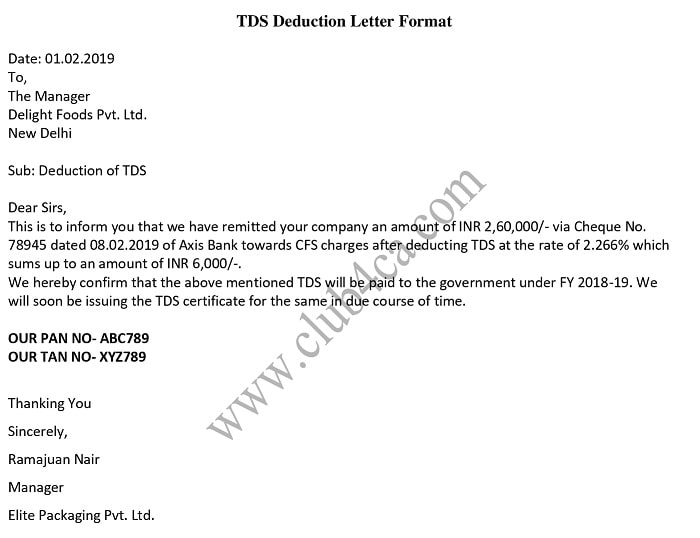

TDS or Tax Deduction at Source, as the name suggests, is a deduction from your salary or any other kind of income which is required to be deposited with the government within a specific period of time. For this TDS certificates are issued by the company to the employees or vendors or customer. We have […]

Continue reading…

Income Tax

7 Indian Income Tax Notices You must know

Whenever we receive an Income Tax notice, we tend to get worried and look for help. Income Tax notice is nothing but a letter seeking clarification on something. If you are a salaried person then not only filing the ITR but also replying to such notices can be done by yourself but if it is […]

Continue reading…

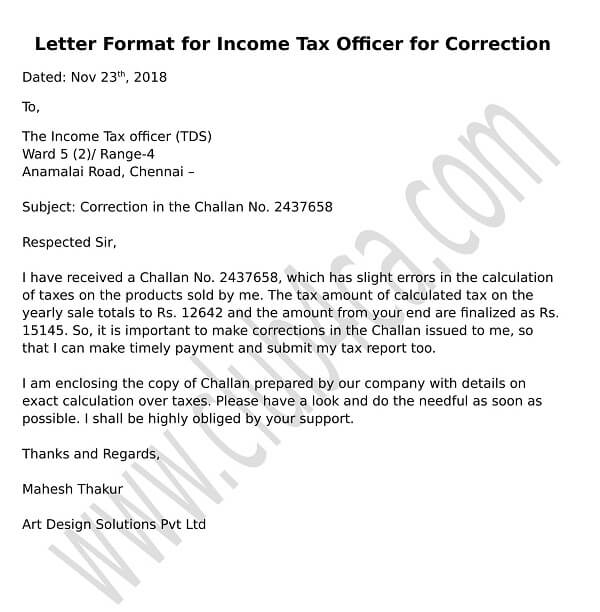

Challan Correction Letter to Assessing Officer

Paying income tax on regular basis is highly mandatory as it may keep the owner of a company safe from legal troubles. Of course, it is the right of the government to get tax amount and use it for the development of the nation. A professional tax payment letter format to the income tax officer […]

Continue reading…

GST Format for Sales & Purchase Summary for Small Businesses

If you have a small business and you are confused with filing GST return or you are clueless about return formats, GST filing process and due dates for filing or you don’t know about GST tax invoice then you don’t need to worry because we are there to help you. To bring more clarity, in […]

Continue reading…

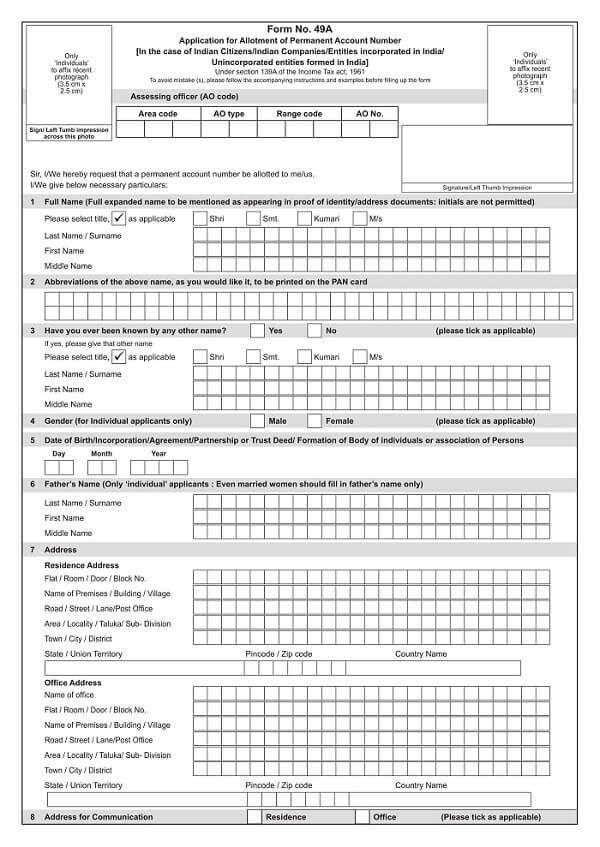

Revised Pan Card Form From 1st July Format in PDF

The revised format for PAN Card application to be followed from Jul 1st, 2017. New format 49A for allocation of Permanent Account Number to Indian citizens and Indian companies along with the guidelines of filling the form and important points required to keep in mind by the applicants while filling this application. If you wish […]

Continue reading…