The Income Tax Act, 1961 governs the taxation of income in India. Income tax is charged on total income

for a given financial year. The financial year runs from 1 April to 31 March of the following year.

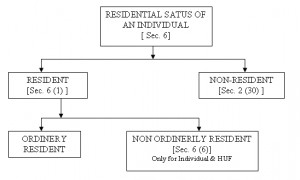

Residential status

The residential status of an individual for income-tax purposes depends on the physical stay of the individual

in India. Based on the period of stay in India in a given financial year, an individual may be classified as:

- Resident

- Not ordinarily resident (NOR)

- Non-resident (NR).

Tests of residence under the act

A. An individual is a resident in India if he stays in India for:

- At least 182 days during a financial year

- At least 60 days during a financial year and 365 days or more during the 4 years preceding that fiscal year.

Exceptions to the above:

- The 60-day period mentioned above will be substituted for 182 days in case of the following persons:-

- A citizen of India who leaves the country as a crew member of an Indian ship or for the purposes of employment outside India

- A Citizen of India or PIO who visits India in any previous year.

B. An individual is an NOR in India if:

- He is an NR in India in 9 of 10 financial years preceding the relevant fiscal year

- His stay in the 7 years preceding the relevant financial year is in the aggregate 729 days or less.

C. An individual is an NR in India if:

- He does not satisfy any of the two conditions mentioned in A above.

NRI

An NRI is defined as a citizen of India or a PIO who is not a resident.

PIO

A person shall be deemed to be of Indian origin if he or either of his parents or grandparents were born in

undivided India.