If you have made a mistake by submitting challan in TAN instead of PAN then you can always write an application to the taxation department for correcting this mistake. It is a simple letter which must include all the details concerning the challan and the mistake made during the submission of the money. Here is […]

Continue reading…

Posts tagged with 'Challan Format'

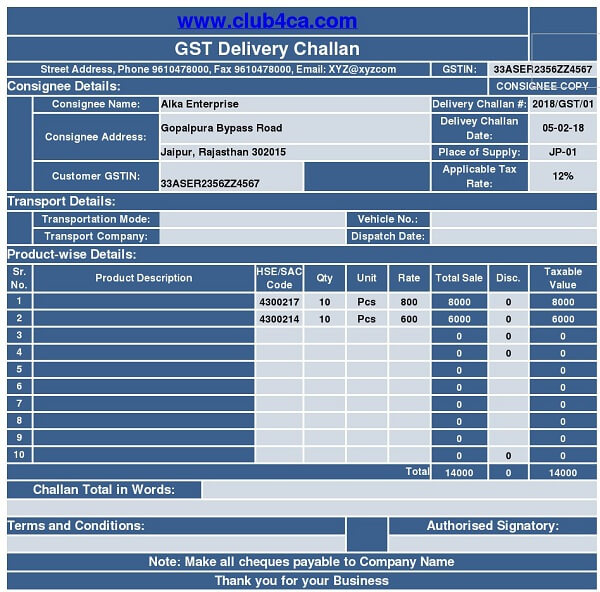

GST Delivery Challan Format in Excel For Transportation of Goods Without Tax Invoice

Usually a GST tax invoice is issued when supply of goods or services is made. But in some cases, a GST delivery challan is issues instead of a GST tax invoice by the consignor. There are some particular instances in which GST delivery challan is issued like transportation of goods for job work, transportation of […]

Continue reading…

Delivery Challan Format

A delivery challan as its name says it is produced while delivering the ordered products to the customer. The bill is made by the product supplier, according to the purchasing order. It is a formal way to dispatch any products to the customer that serves a proof of purchasing the goods. This document should be […]

Continue reading…