Custom duty is another form of indirect tax levied on all the goods and services imported and some specific goods exported outside the country. Duties levied on goods imported is known as import duty and duty levied on exported goods is export duty. It is a means of revenue to domestic countries to preventive predatory competition from other countries. If duty is levied based on the value of the goods it is known as valorem duty. If duty is levied based on the weight/quantity it is called specific duty.

How this custom duty is calculated in India?

Custom duties are calculated on valorem or specific duties. This value is calculated based on rule 3(1) of customs valuation. If quantifying or measurable data is not adequate to calculate the custom’s duty, and there are doubts as per Rule 12, then valuation has to be done in a hierarchy which is as follows:

- Comparative Value Method which compares the transaction value of similar items (Rule 4)

- Comparative Value Method which compares the transaction value of similar items (Rule 5)

- Deductive Value Method which uses the sale price of item in importing country (Rule 7)

- Computed Value Method which uses the costs related to fabrication, materials and profit in production country (Rule 8)

- Fallback Method which is based on the earlier methods with higher flexibility (Rule 9)

ICEGATE allows e-filing services to clients.

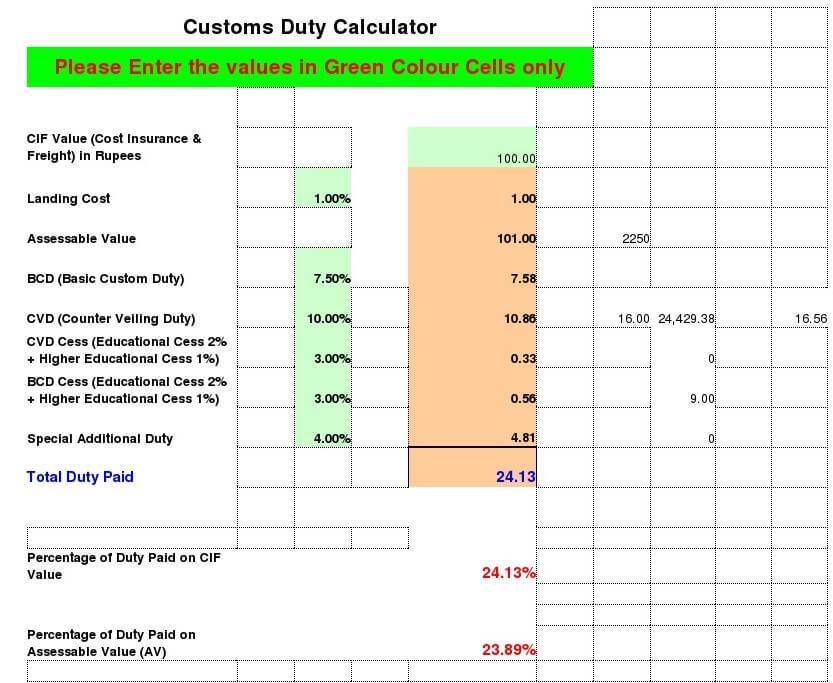

Indian Custom Duty Calculator

The custom duty calculator can be accessed through ICEGATE portal. Enter the HS Code (CTH Code) of the goods to be imported. Description of the product in thirty words is to be given, and then the origin country has to be specified. Select the goods to be imported from the list that matches search criteria. Once selected, you will get access to a dynamic chart with all the information relating to customs duty. Enter values, and the chart will calculate the values automatically and will give you the customs duty to be paid.

You can Download the example of Custom Duty Calculation Sheet in Excel Format.

Other Related Letter Formats

Request Letter Format for Tax Exemption from Sales

Authority Letter To Send to Deputy Commissioner of Customs

Calculation of Customs Duty in Excel Format

Shipping Bill for Export of Duty Free Goods Ex-Bond PDF Format

Guidelines on Applying for IEC for Commercial Import Export of Goods

GST Invoice Format to Sell Goods on MRP Including Taxes

Easy GST Bill Format for Non-Taxable Goods & Services

Request Letter to Customs Officer to Release Goods

Top File Download:

- custom duty calculation sheet

- customs duty calculator excel

- duty calculation sheet in excel

- customs clearing Excel calculations

- import costing excel

- how to compute duty in nigeria in excel format

- how to create excel for import duty calculation

- hs code rates of duty excel

- imgurl:https://www club4ca com/formats/wp-content/uploads/2018/01/custom-duty-calculation-excel-format jpg

- indian customs duty calculator 2020